Farm Succession Planning

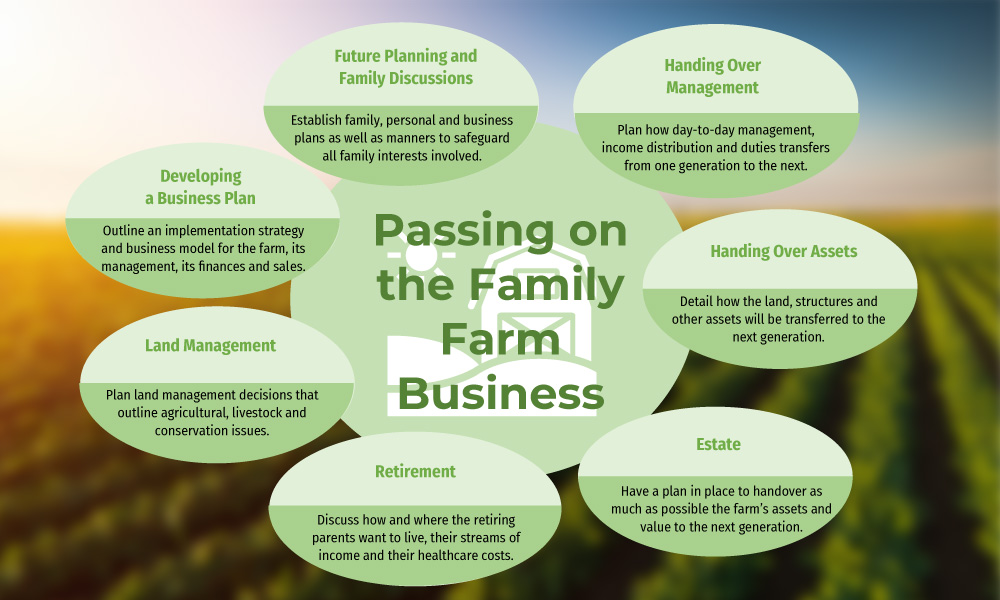

Before passing your farm on to the next generation or transferring it to someone else who wants to use it for their own farming operations, it is prudent to prepare a farm transfer action plan that includes a transfer timeline and all required documents for facilitating the handover.

Nine Farm Succession-Planning Mistakes to Avoid

Farm owners hope to pass on the business someday to the next generation. Most owners expect to pass on the achievement of their hard-work and toil – in this case, to their children, but in some cases to an employee or an outside party. This transfer in owning the farm is the vehicle for financing the owner’s retirement and extend the operation for generations to come. Unfortunately, many farm owners fall into various pitfalls related to the transfer of ownership, leading to disappointment. Here are nine common mistakes to avoid in order to make sure you have a successful transfer process:

Developing plans by yourself. Transferring the business to the next generation is complex and burdened with problems. Succession planning professionals can be very useful, especially someone who can bring your family together and can guide the process planning through their experience and personal assessment. Before moving forward with your succession planning, look into engaging a business succession professional.

Developing plans by yourself. Transferring the business to the next generation is complex and burdened with problems. Succession planning professionals can be very useful, especially someone who can bring your family together and can guide the process planning through their experience and personal assessment. Before moving forward with your succession planning, look into engaging a business succession professional.

Will your children want to take over the family farm? In many cases the children have been groomed to eventually take over the farm, in many cases not. The children may want to work in another profession (e.g. as a lawyer, stock-broker or business owner in a non-agricultural industry). As the parent, you need to discuss with them their stance on the issue. Leave the door open for them to enter into the business, but do not conditionalize them to do so. This will only alienate them and place them in a position they do not want to be in and could be a calamity for the business in the long-run. In the end, it is not the right thing to do and may lead to internal family squabbles. The sooner you learn their feelings on taking over the business, the sooner you can take action to identify other options to sell to outside parties, such as an external buyer or an existing employee.

Will your children want to take over the family farm? In many cases the children have been groomed to eventually take over the farm, in many cases not. The children may want to work in another profession (e.g. as a lawyer, stock-broker or business owner in a non-agricultural industry). As the parent, you need to discuss with them their stance on the issue. Leave the door open for them to enter into the business, but do not conditionalize them to do so. This will only alienate them and place them in a position they do not want to be in and could be a calamity for the business in the long-run. In the end, it is not the right thing to do and may lead to internal family squabbles. The sooner you learn their feelings on taking over the business, the sooner you can take action to identify other options to sell to outside parties, such as an external buyer or an existing employee.

Holding off until the day you decide to retire, or worse. At the other end of the story is waiting too long to groom the children for inclusion in the business, arriving at the inheritance stage. All too often, farm owners wait till the day they retire (or even pass away) to make such plans known, which at that stage the child is, sadly , no longer interested in and/or is up to the task of taking over the farm. Before you reach that point, discuss with your children your ideas and plans, and let them come to their own decisions. Include them in the process of dealing with suppliers and buyers, customers and staff. In the end, give them space to learn how the business works and if they make a few mistakes, it’s all part of the learning curve. We all had to start somewhere

Holding off until the day you decide to retire, or worse. At the other end of the story is waiting too long to groom the children for inclusion in the business, arriving at the inheritance stage. All too often, farm owners wait till the day they retire (or even pass away) to make such plans known, which at that stage the child is, sadly , no longer interested in and/or is up to the task of taking over the farm. Before you reach that point, discuss with your children your ideas and plans, and let them come to their own decisions. Include them in the process of dealing with suppliers and buyers, customers and staff. In the end, give them space to learn how the business works and if they make a few mistakes, it’s all part of the learning curve. We all had to start somewhere

Delaying planning to the last moment. Most business owners will postpone succession planning to the very last moment. In many cases, there is no planning at all. The best-case scenario of a succession plan is in developing it over years and, if possible, planning your exit strategy early on, even from when your business begins. Developing a strategy for your future departure from the business will dictate how you set up and run the business today.

Delaying planning to the last moment. Most business owners will postpone succession planning to the very last moment. In many cases, there is no planning at all. The best-case scenario of a succession plan is in developing it over years and, if possible, planning your exit strategy early on, even from when your business begins. Developing a strategy for your future departure from the business will dictate how you set up and run the business today.

Postponing thinking about your retirement. Retiring from your business can be challenging due to the all-encompassing nature of owning and operating a business and the identity of the business having become intertwined with the personality of the owner themselves. Many retirees do not have a clear idea of what they want to do after retiring, eventually returning to the business, interfering with the current state of management and in the process becoming an obstacle to operations.

Postponing thinking about your retirement. Retiring from your business can be challenging due to the all-encompassing nature of owning and operating a business and the identity of the business having become intertwined with the personality of the owner themselves. Many retirees do not have a clear idea of what they want to do after retiring, eventually returning to the business, interfering with the current state of management and in the process becoming an obstacle to operations.

Not being open about your retirement plans. Due to uncertainty, most business owners are reluctant to reveal their succession plans. Most often this is due to concern about raising discussions about the business transfer and the family’s role in it. Sometimes this is due to just wanting to avoid the topic of money and inheritance. In the long-term, this is the wrong approach to your children and most likely a future obstacle to the business. The quicker your ideas and plans for the business are brought out into the open, the sooner they can see how they fit into the succession process, it allows them to adjust their plans to yours as appropriate. In the end, the best idea is to speak with your heirs, holding family meetings periodically to keep them up-to-date.

Not being open about your retirement plans. Due to uncertainty, most business owners are reluctant to reveal their succession plans. Most often this is due to concern about raising discussions about the business transfer and the family’s role in it. Sometimes this is due to just wanting to avoid the topic of money and inheritance. In the long-term, this is the wrong approach to your children and most likely a future obstacle to the business. The quicker your ideas and plans for the business are brought out into the open, the sooner they can see how they fit into the succession process, it allows them to adjust their plans to yours as appropriate. In the end, the best idea is to speak with your heirs, holding family meetings periodically to keep them up-to-date.

Leaving your family out of the circle of trust. Along with this, not trusting your family enough and failing to handover heir authority to the business. Many parents have trust issues with their children. They often lack confidence that their children are doing the right thing and, thus, overly monitor their day-to-day activities. In the end, this may just drive them away . This will create an environment of mistrust. Remember, family is family.

Leaving your family out of the circle of trust. Along with this, not trusting your family enough and failing to handover heir authority to the business. Many parents have trust issues with their children. They often lack confidence that their children are doing the right thing and, thus, overly monitor their day-to-day activities. In the end, this may just drive them away . This will create an environment of mistrust. Remember, family is family.

Not letting your children work for another business. Children should go out into the real world and work for someone else before returning back to the family business. This will give them a valuable perspective on how others work and provide them with important experience when they return back to the farm. In the end, this will give them a wider perspective on the world and dispel any doubts if they want to take over the farm.

Not letting your children work for another business. Children should go out into the real world and work for someone else before returning back to the family business. This will give them a valuable perspective on how others work and provide them with important experience when they return back to the farm. In the end, this will give them a wider perspective on the world and dispel any doubts if they want to take over the farm.

![]() Dividing the business fairly among multiple children. Evenly distributing partnership over the inheriting children is bad approach to the idea. Children have differing skill sets, different interests, likely impending disagreements, different plans and, ultimately, different ideologies. In the end, it is best that only one offspring should run the business. As a parent, you need to start early evaluating which of your children has the skills, drive and real interest to assume control of the business. You will also have to take into account if the child, or children, do not want to be involved in the business. In such cases, develop a plan to leave the child(ren) non-business assets that will count as their shares, dividends and/or insurance. Be mindful that such measures may lead to conflict with the non-business children.

Dividing the business fairly among multiple children. Evenly distributing partnership over the inheriting children is bad approach to the idea. Children have differing skill sets, different interests, likely impending disagreements, different plans and, ultimately, different ideologies. In the end, it is best that only one offspring should run the business. As a parent, you need to start early evaluating which of your children has the skills, drive and real interest to assume control of the business. You will also have to take into account if the child, or children, do not want to be involved in the business. In such cases, develop a plan to leave the child(ren) non-business assets that will count as their shares, dividends and/or insurance. Be mindful that such measures may lead to conflict with the non-business children.